Why Do You Need MATVIO GOALS?

Financial stress affects millions of families. MATVIO gives you the tools to eliminate confusion and build financial security.

"After using Microsoft Money and the Sunset edition for almost 25 years, we decided to create our own modern personal finance tool that we use daily! It was so good we thought we should share it for others to eliminate stress around money management and begin to enjoy managing finances again!"

The Problem

67% of families live paycheck to paycheck. Most people can't answer "Will I have enough money next month?" Traditional budgeting apps show the past, but don't forecast the future.

The Solution

MATVIO combines real-time tracking with powerful forecasting. See your financial future before it happens. Plan for bills, avoid overdrafts, and achieve your goals with confidence.

AI-Powered Intelligence

Our optional Groq AI integration transforms raw financial data into actionable insights. Get instant summaries of your spending, personalized recommendations, and intelligent analysis of your financial health—all powered by cutting-edge AI technology.

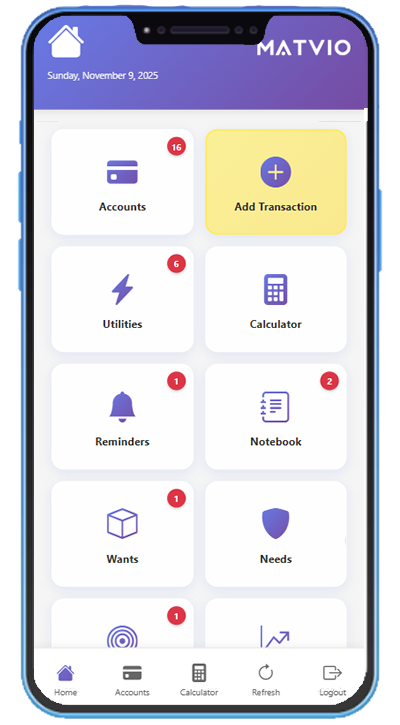

Mobile Companion App

Take MATVIO everywhere with our Progressive Web App (PWA). Add transactions on the go, check balances from anywhere, and manage your finances from your phone. Install to your home screen for a native app experience—no app store required!

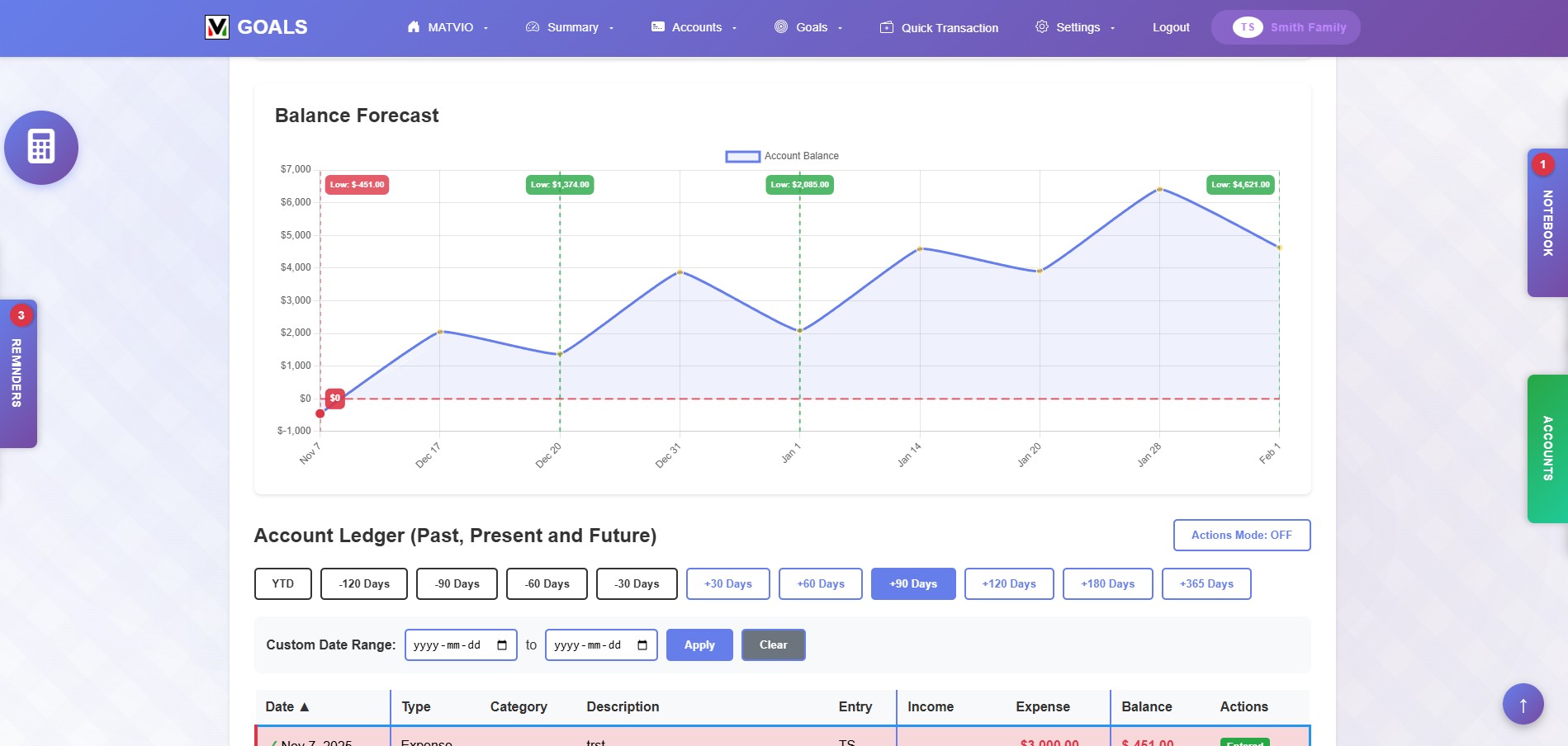

Smart Forecasting Engine

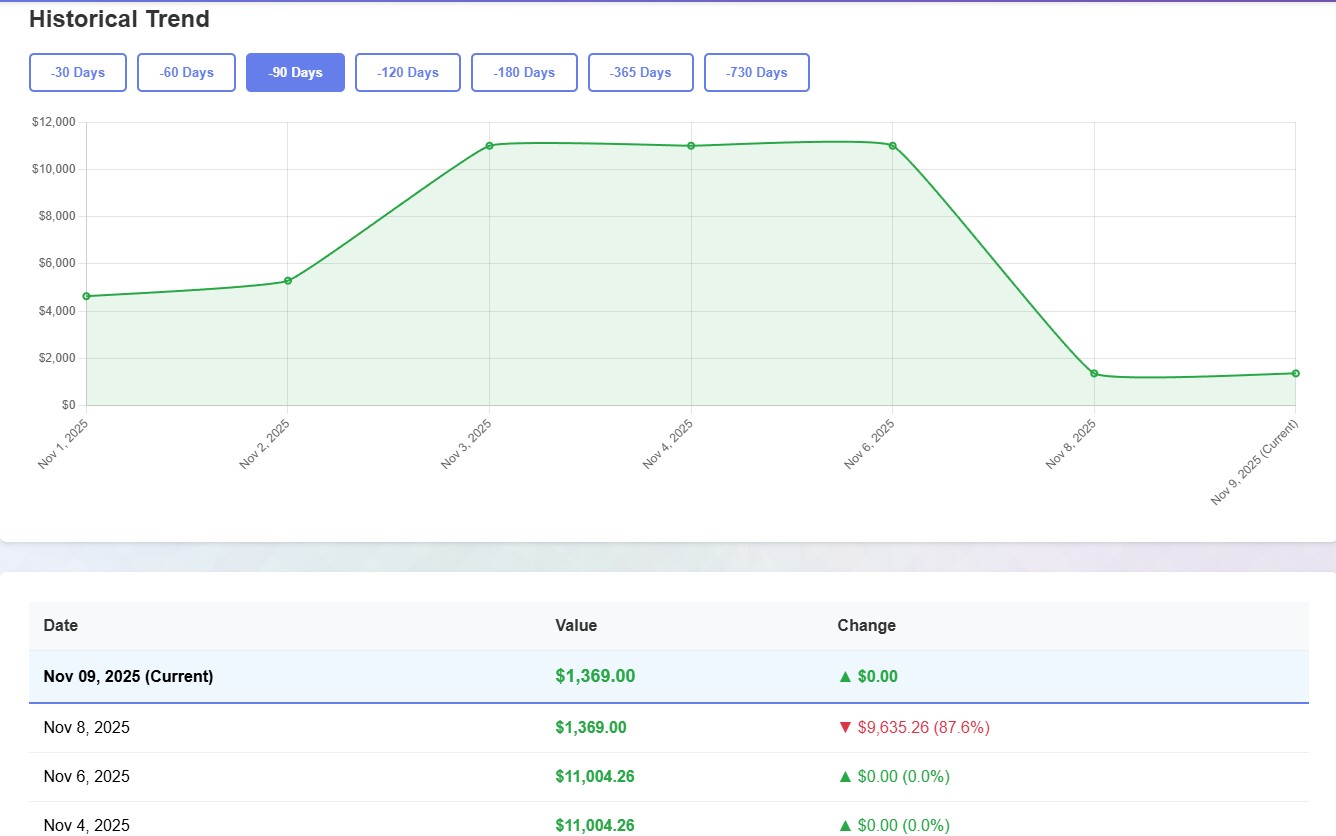

See your financial future with interactive charts and forecasts up to 730 days ahead. Track account balances before they happen, visualize spending patterns, and spot potential overdrafts before they occur. Plan with confidence, not guesswork.

The Results

Users report reduced financial stress, eliminated overdraft fees, and achieved savings goals 3x faster. Know exactly where you stand today and where you'll be tomorrow.

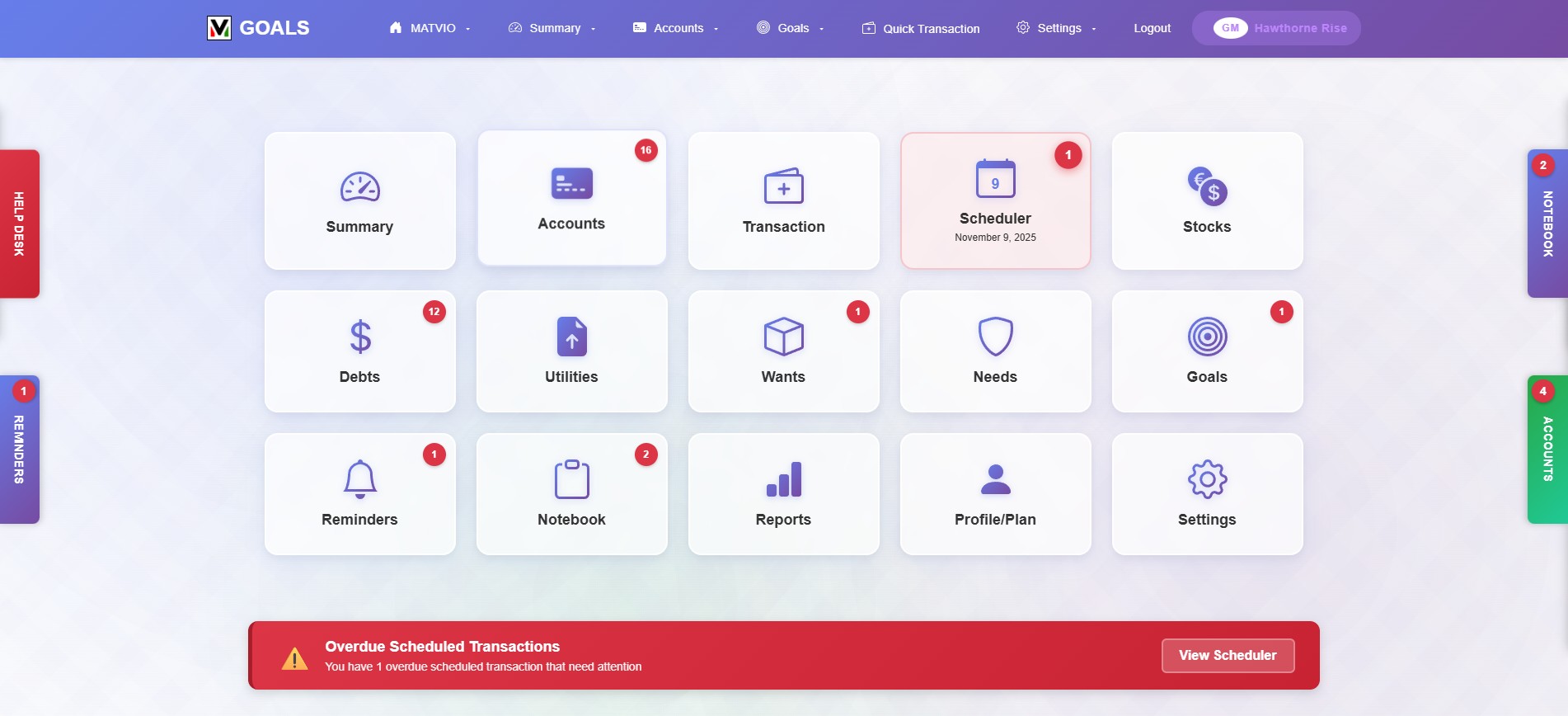

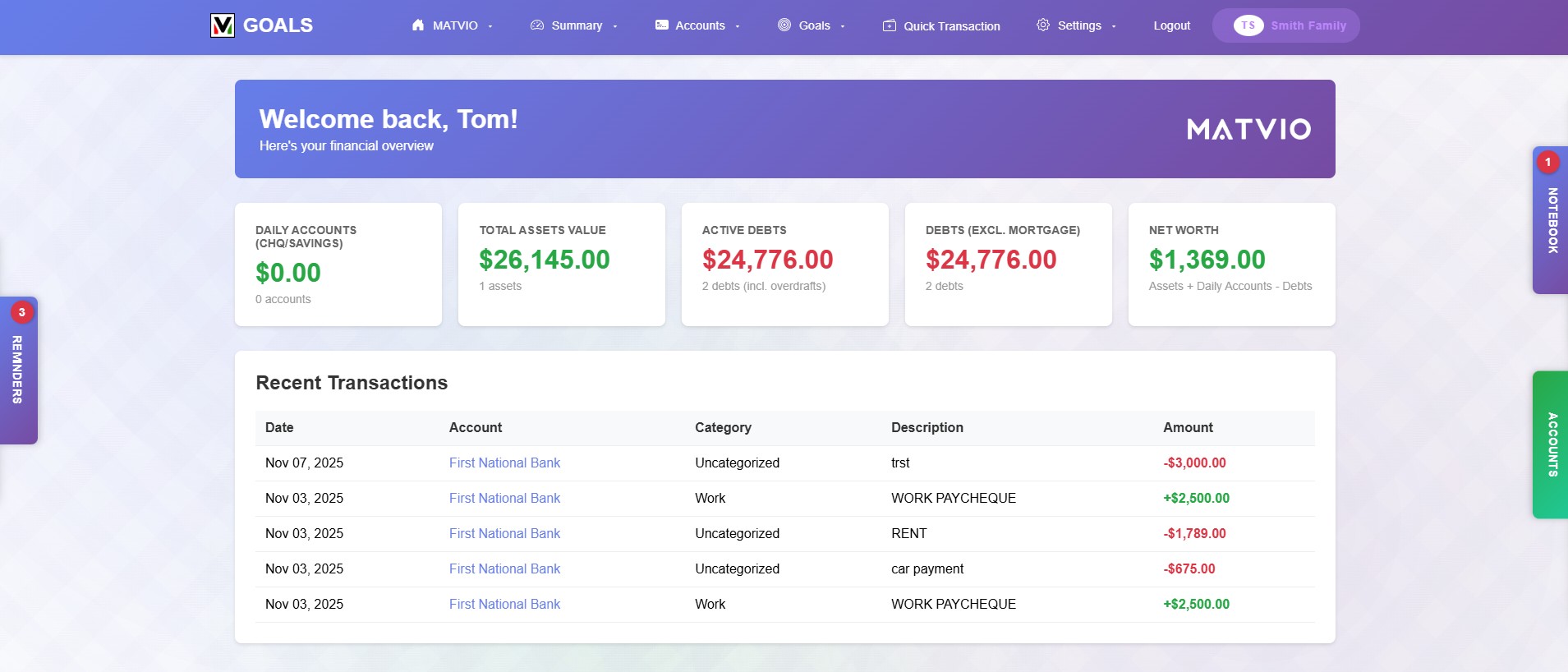

Complete Financial Control At Your Fingertips

Experience the power of comprehensive financial management with intuitive dashboards, real-time tracking, and intelligent forecasting—all designed to help you achieve your financial goals.

Powerful Features Made Simple

Everything you need to manage money like a pro—no accounting degree required.

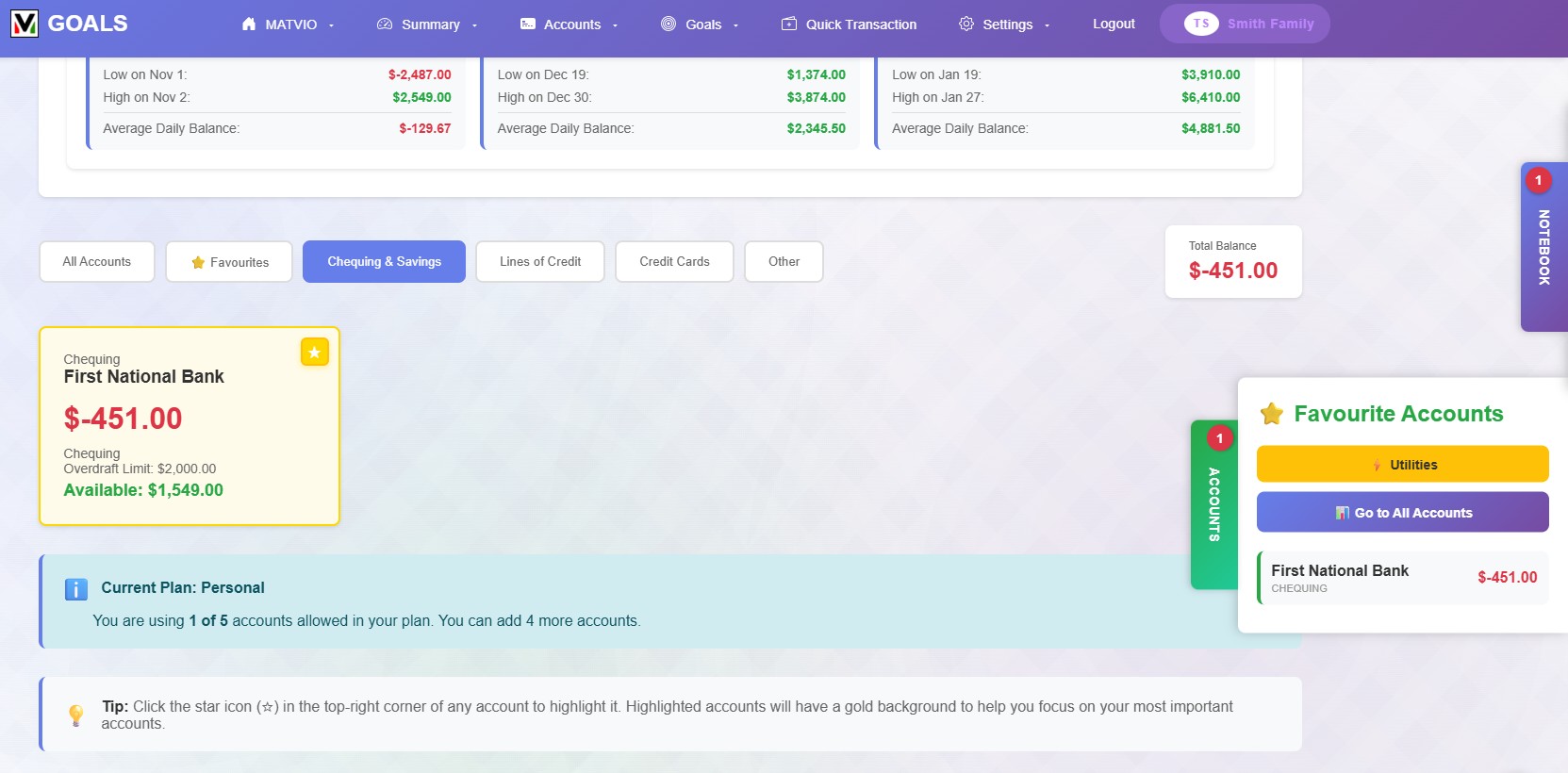

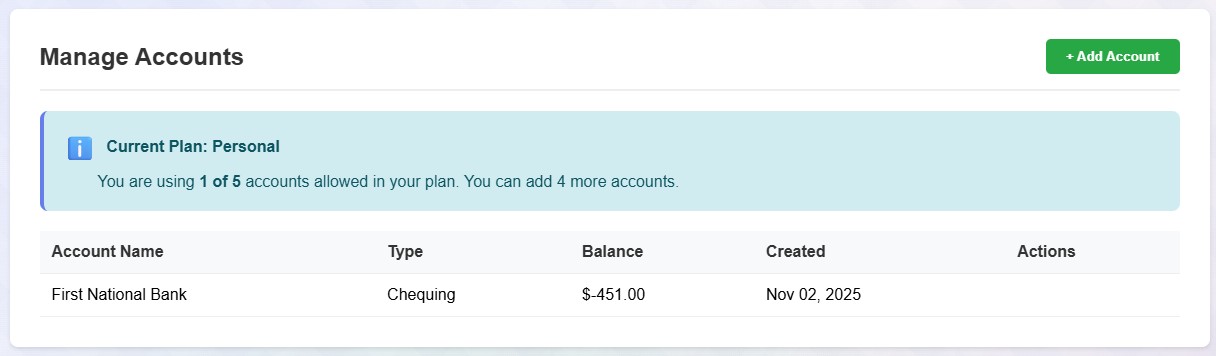

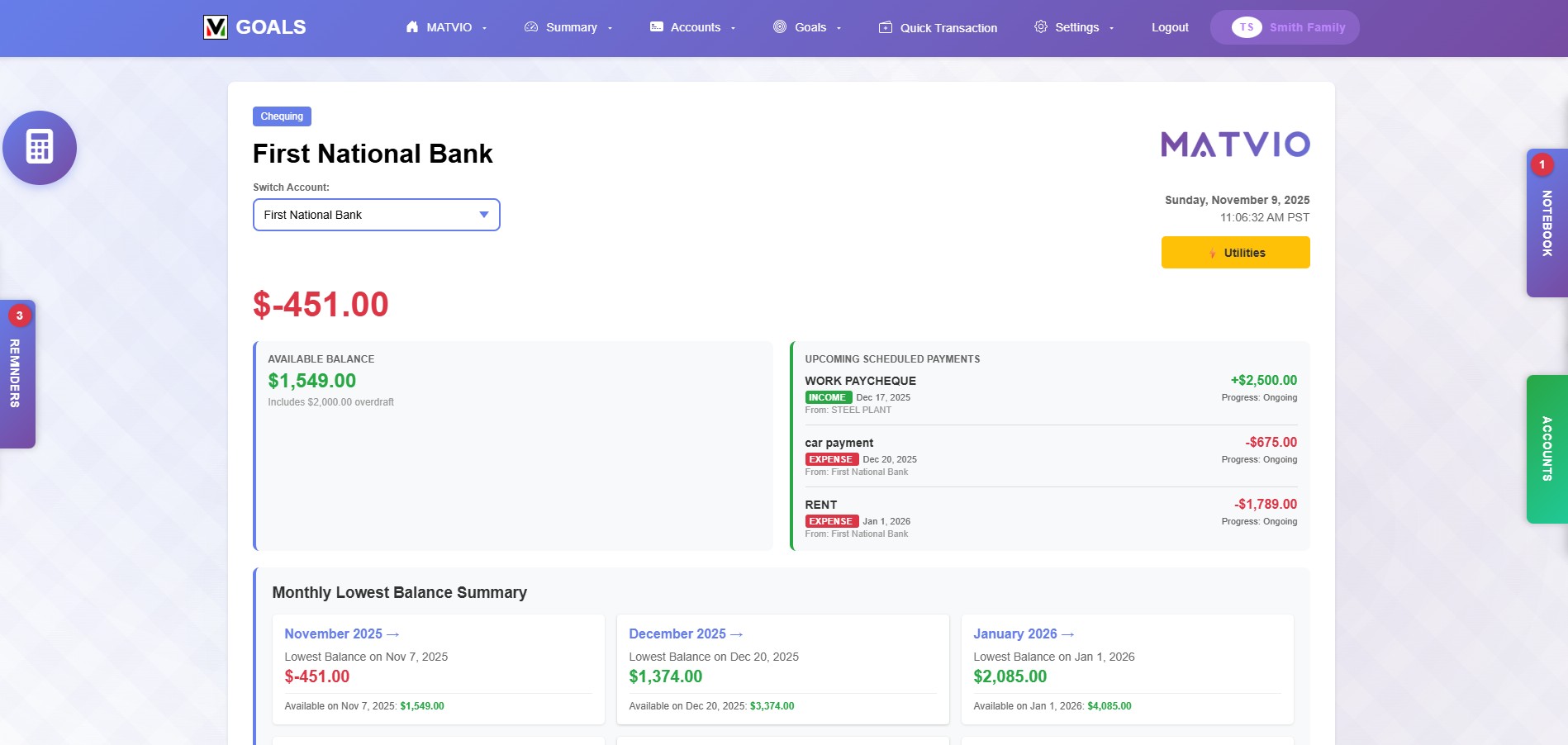

Multi-Account Management

Track all your accounts in one place: chequing, savings, credit cards, loans, investments, and cash. See your complete financial picture instantly.

Visual Forecasting

Interactive charts show your account balances 30, 60, 90+ days into the future. Spot cash flow problems before they happen.

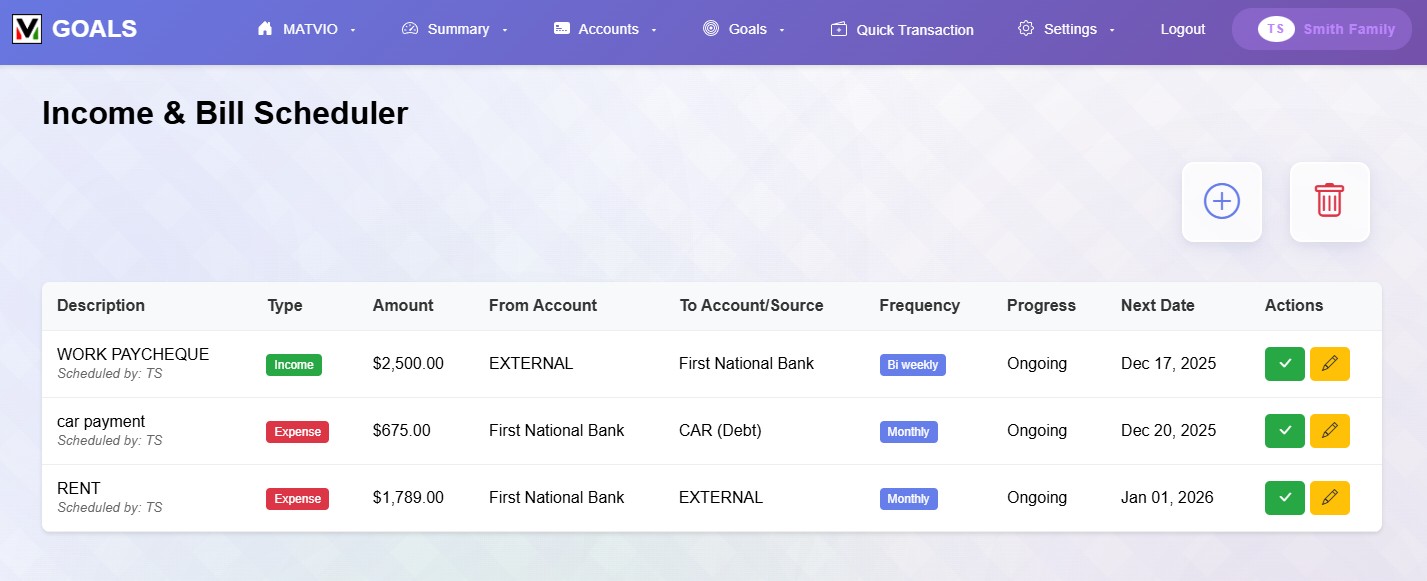

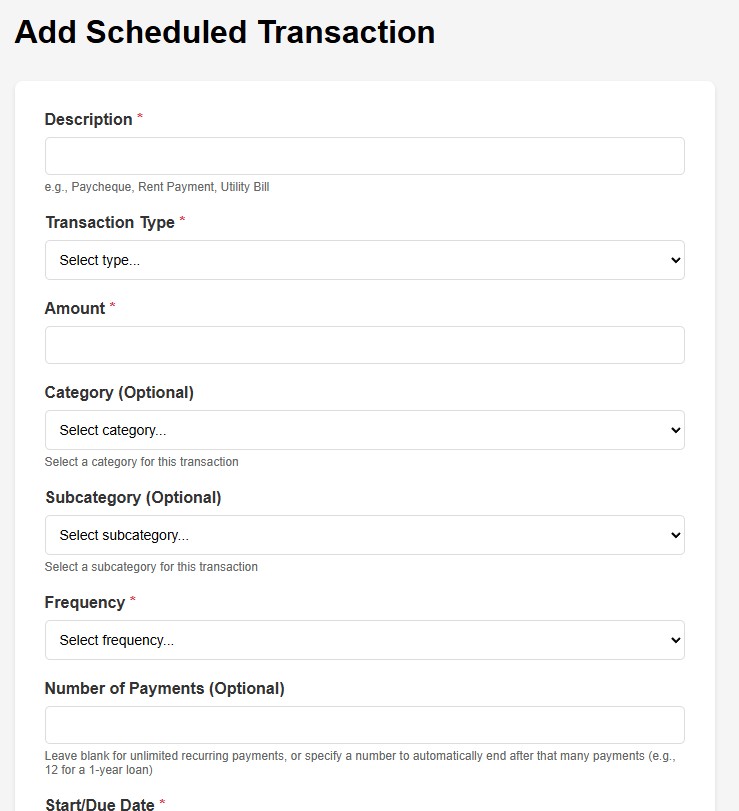

Smart Scheduler

Set up recurring income and bills once. MATVIO automatically forecasts them into the future.

Interactive Calendar View

Visualize your daily account balances on a color-coded calendar. See at a glance when you'll have positive or negative balances with green/red/yellow indicators.

Smart Color Coding System

Instant visual clarity: green for income/positive balances, red for expenses/negative balances, yellow for forecasted transactions, blue for today. Monthly high/low indicators help you spot critical cash flow points.

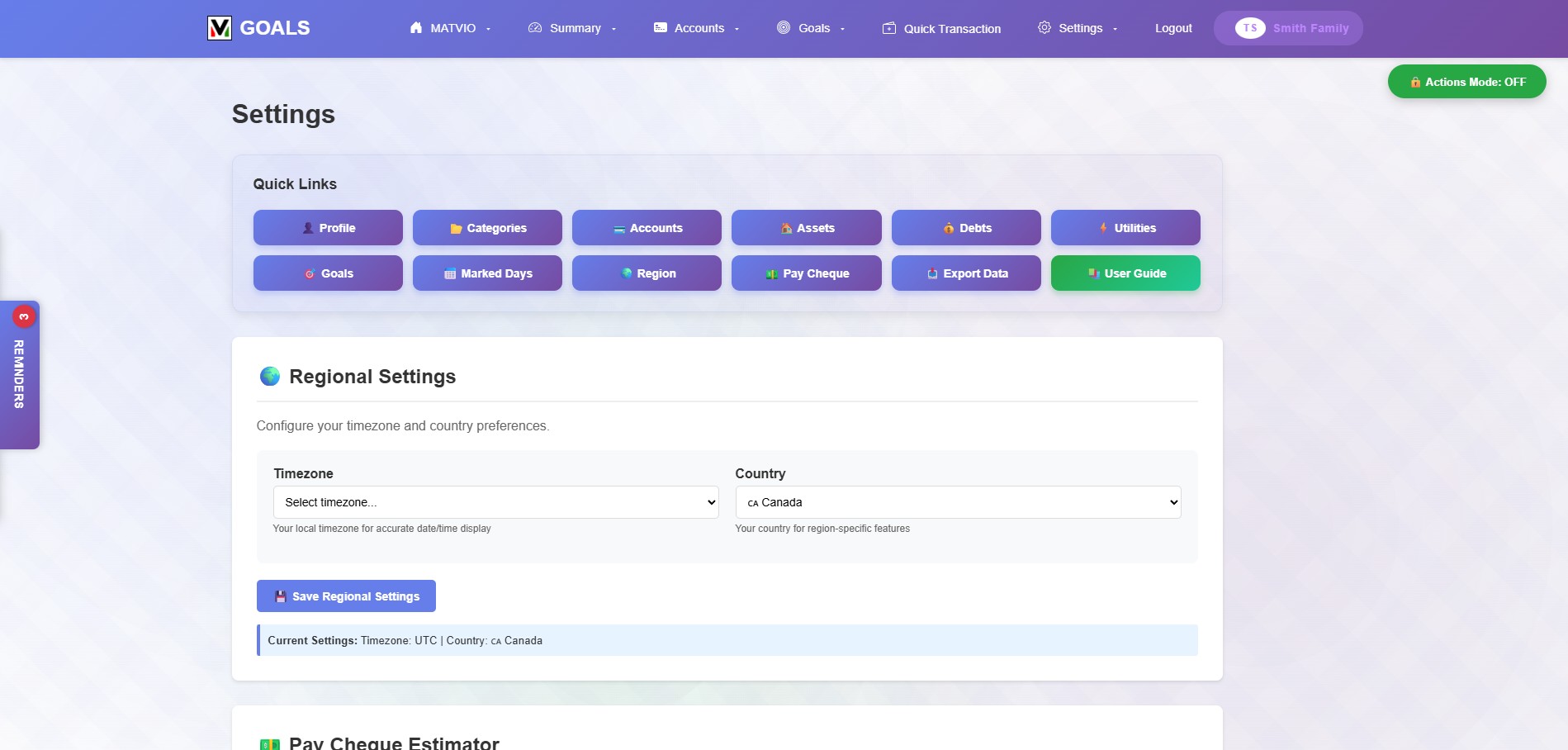

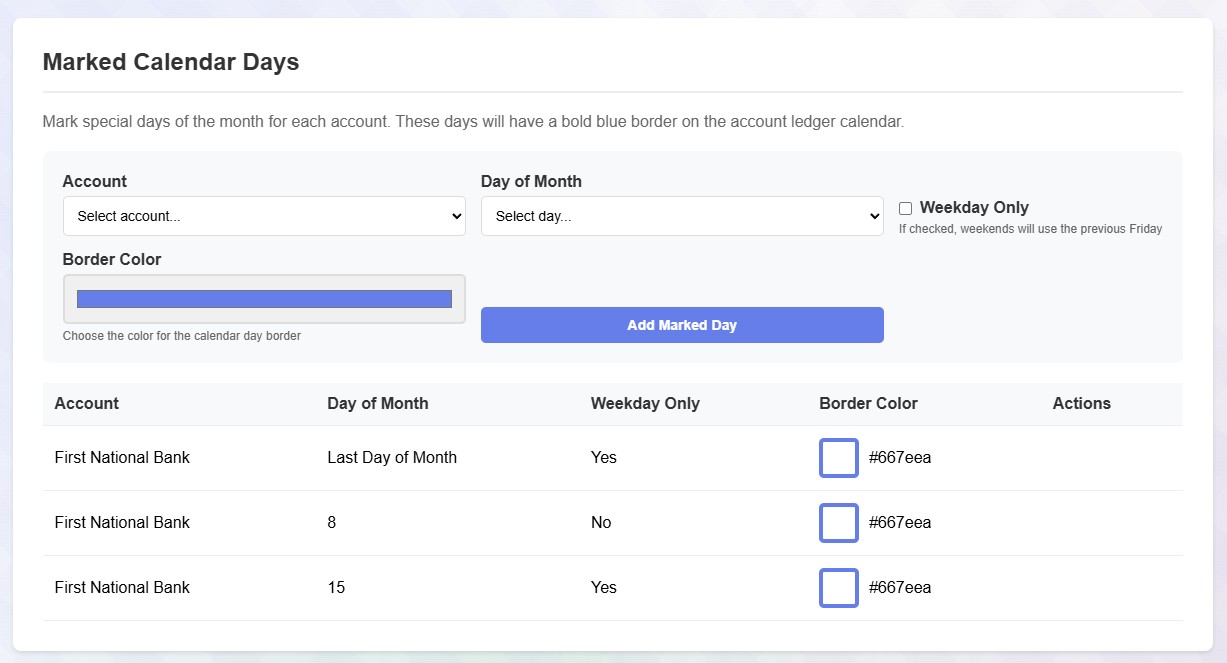

Marked Calendar Days

Mark important recurring dates with custom colored borders. Perfect for paydays, bill due dates, tax deadlines, and financial milestones. Set weekday-only options for bi-weekly payroll.

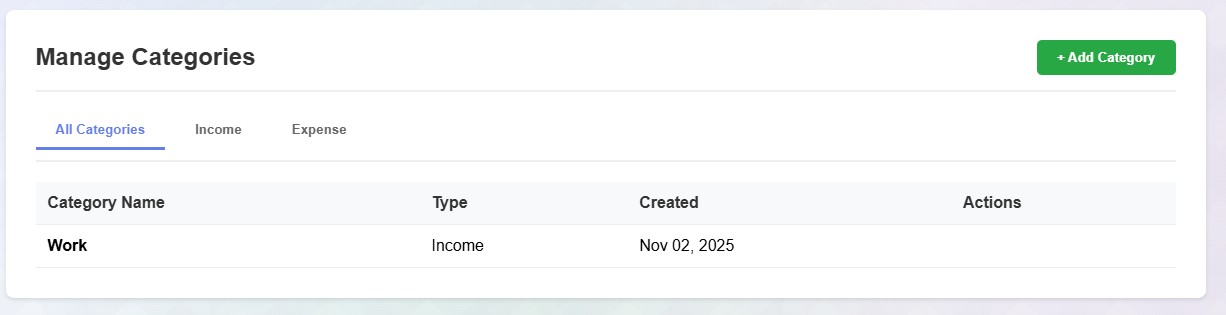

Advanced Category Management

Organize spending with main categories and unlimited subcategories. Track every dollar with precision using customizable income and expense categories tailored to your lifestyle.

Diagnose & Repair Tools

Built-in diagnostic tools automatically detect and fix account balance discrepancies. One-click balance recalculation ensures your financial data is always accurate.

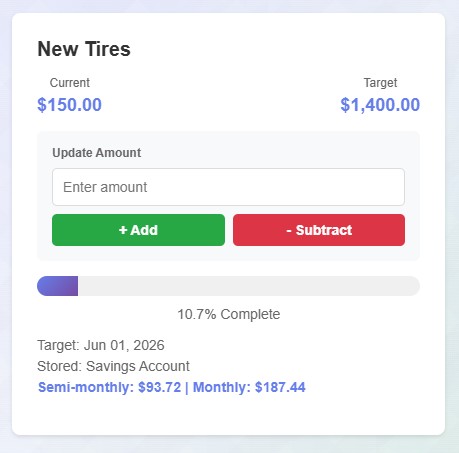

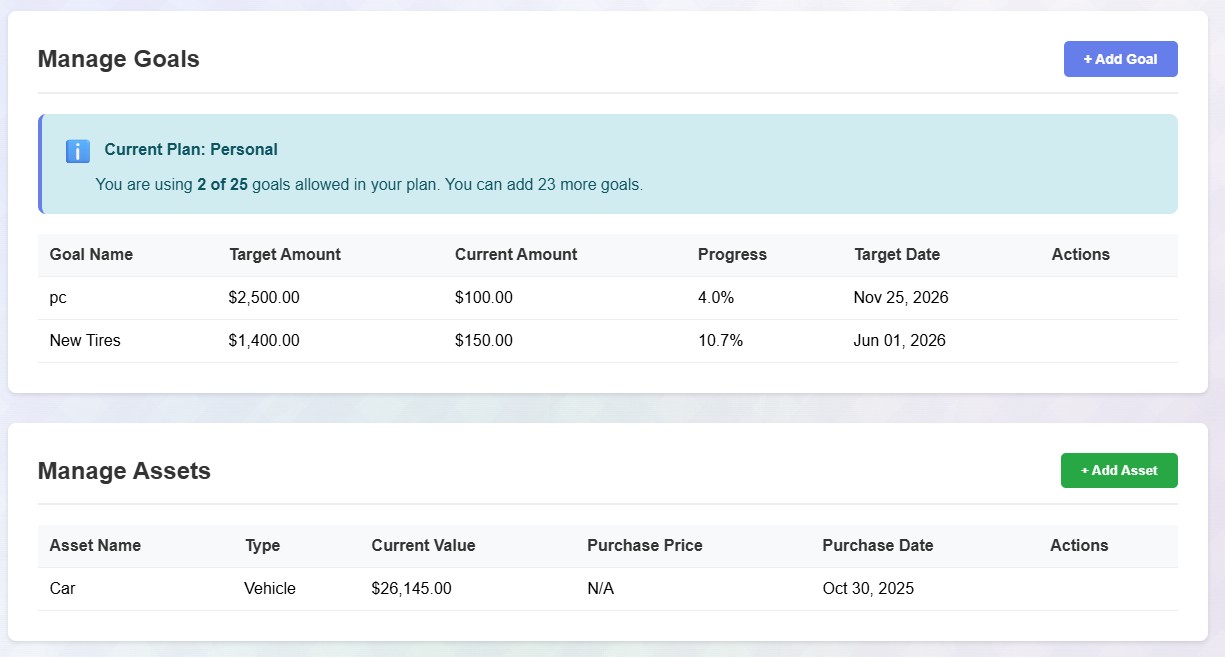

Goal Tracking

Set savings goals for emergencies, vacations, or big purchases. Visual progress bars keep you motivated and on track.

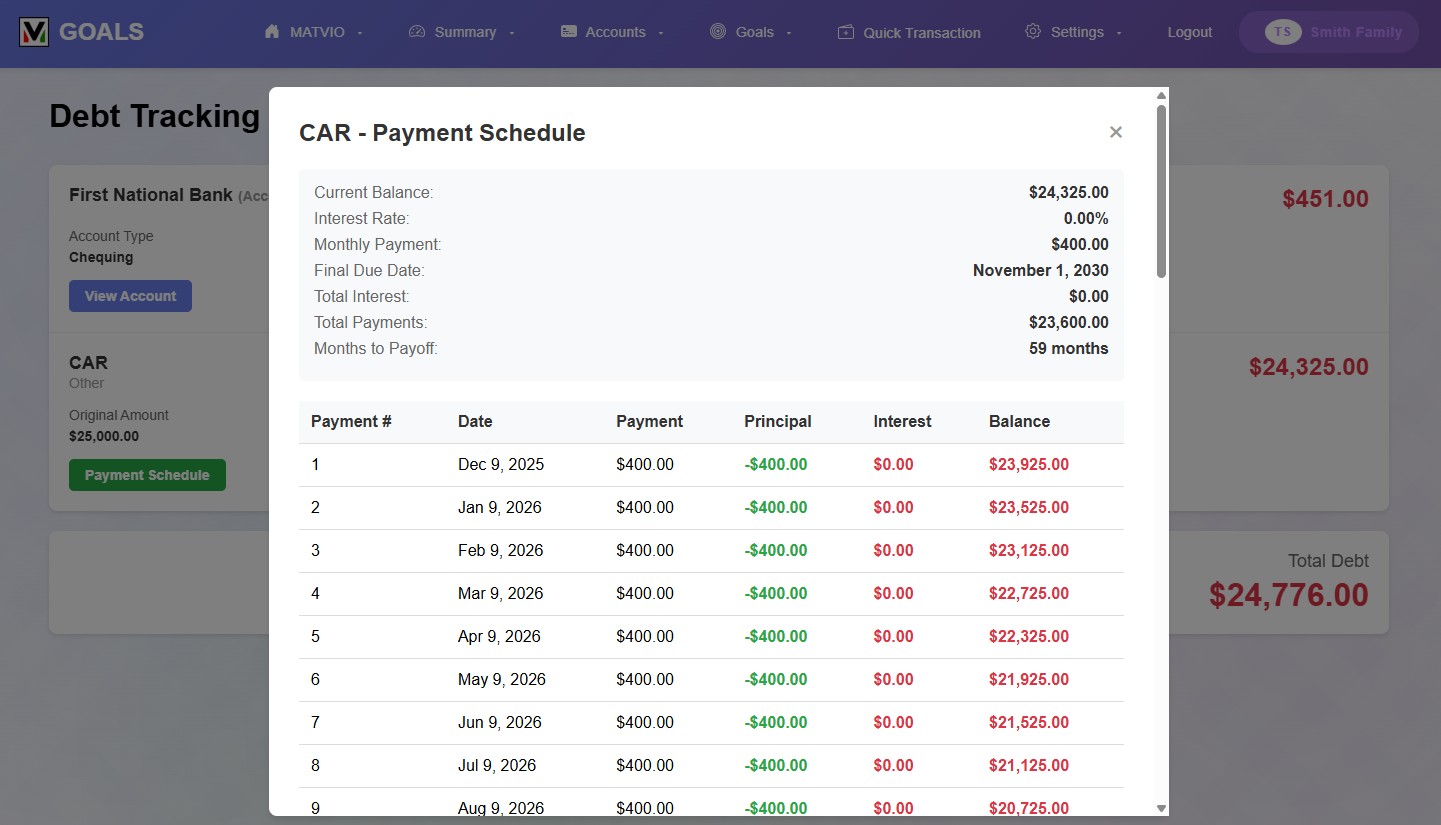

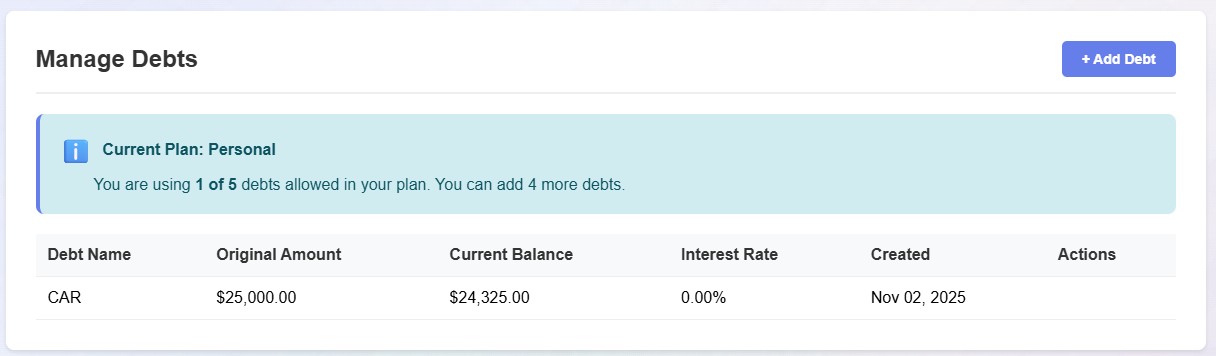

Debt Payoff Planner

Track mortgages, loans, and credit cards. See payment schedules, interest breakdowns, and payoff dates with Canadian or USA-style mortgage calculations.

Smart Categories

Organize spending with categories and subcategories. See exactly where your money goes with detailed reports.

Utilities Tracker

Manage variable bills like electricity, water, and internet separately. Track payment history and due dates.

Bank Import (OFX/QFX)

Import transactions directly from your bank using OFX or QFX files. Automatic duplicate detection, preview before importing, and secure processing with immediate file deletion.

Mobile PWA

Full-featured mobile app works on any device. Add transactions on the go, check balances anywhere. Install to home screen!

Family Sharing

Multiple users in one household can access the same accounts. Track who made which transactions with user initials.

Private & Secure

Your data is yours. Secure login with password and 4-digit PIN. Login history tracking and separate databases for complete privacy.

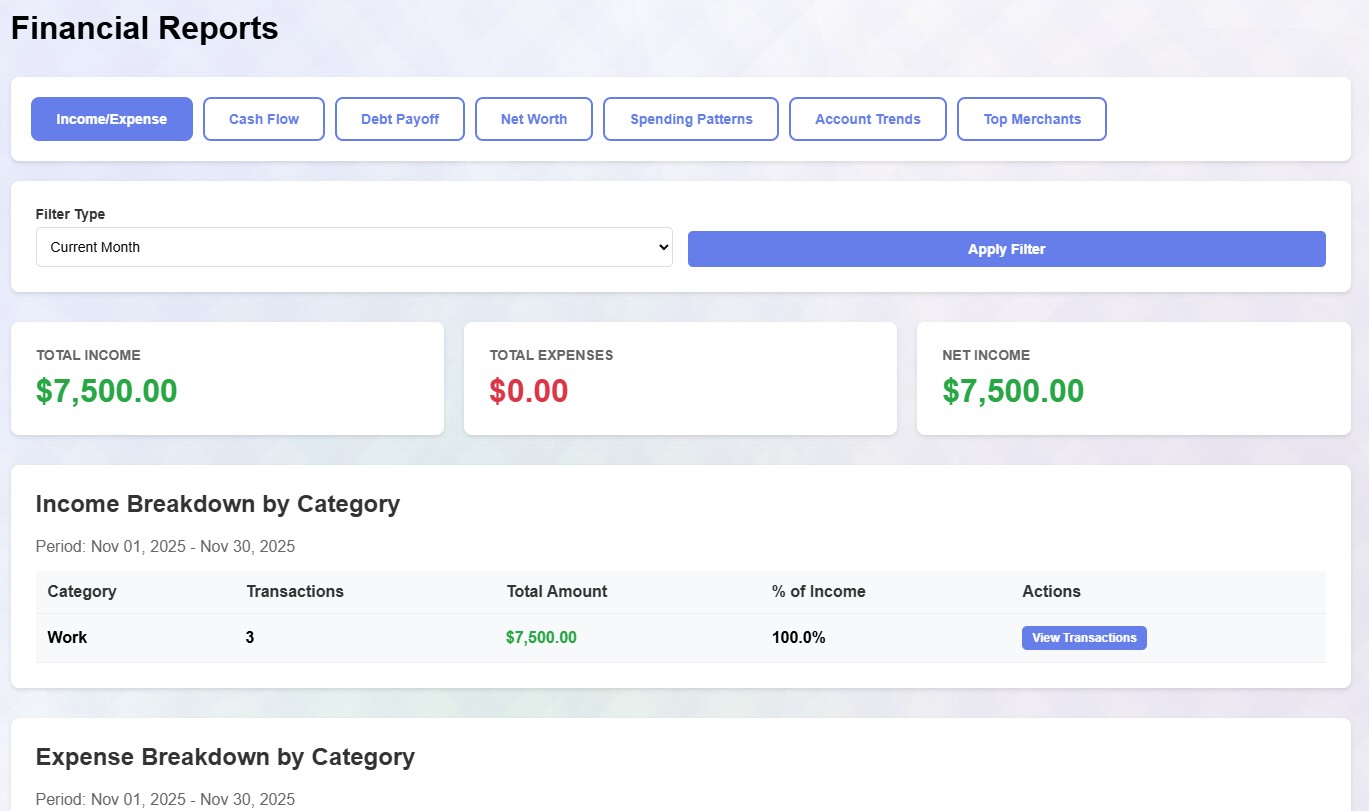

Detailed Reports

Monthly spending reports by category. Interactive pie charts and transaction breakdowns show exactly where your money goes.

Asset Tracking

Track the value of your home, vehicles, investments, and other assets. Calculate true net worth over time.

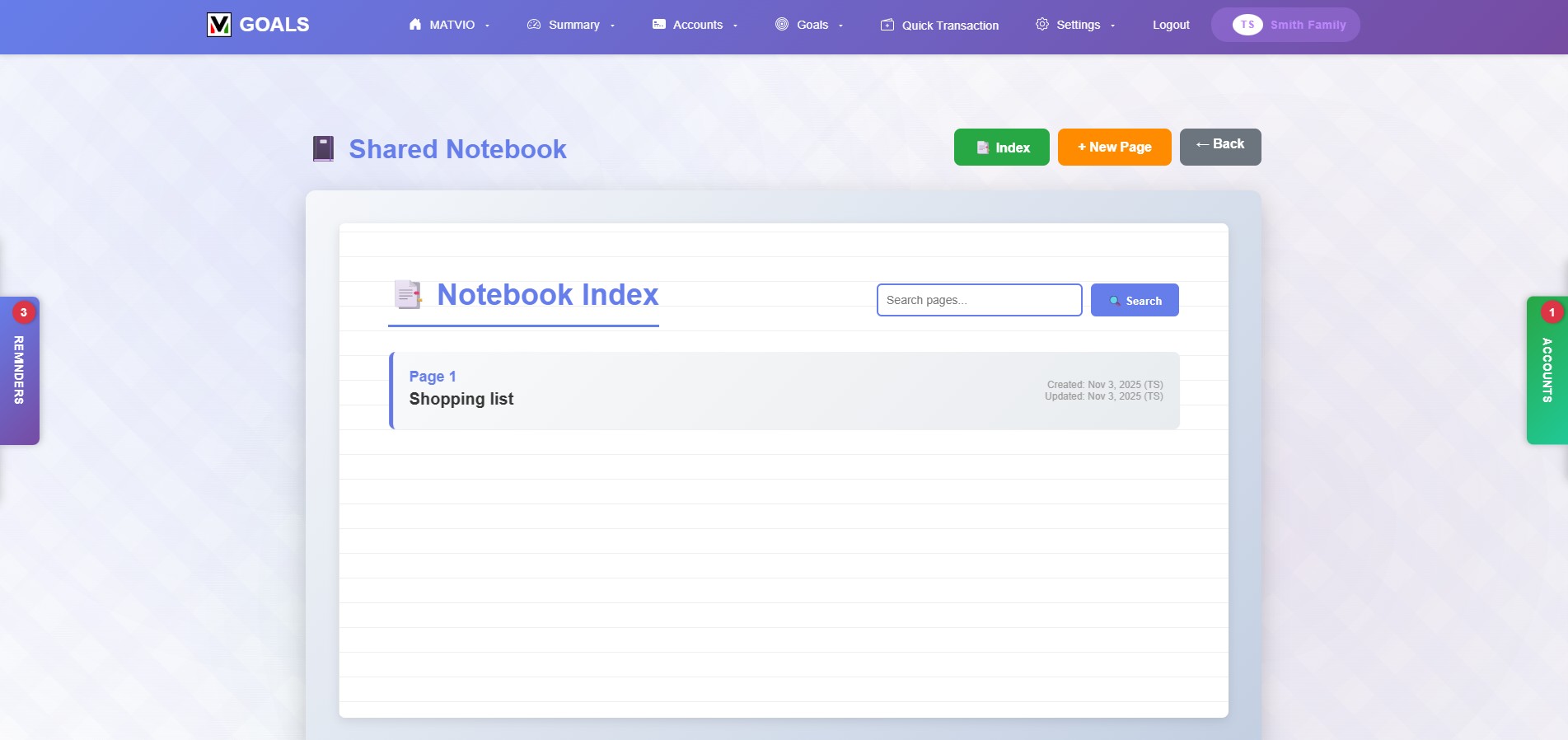

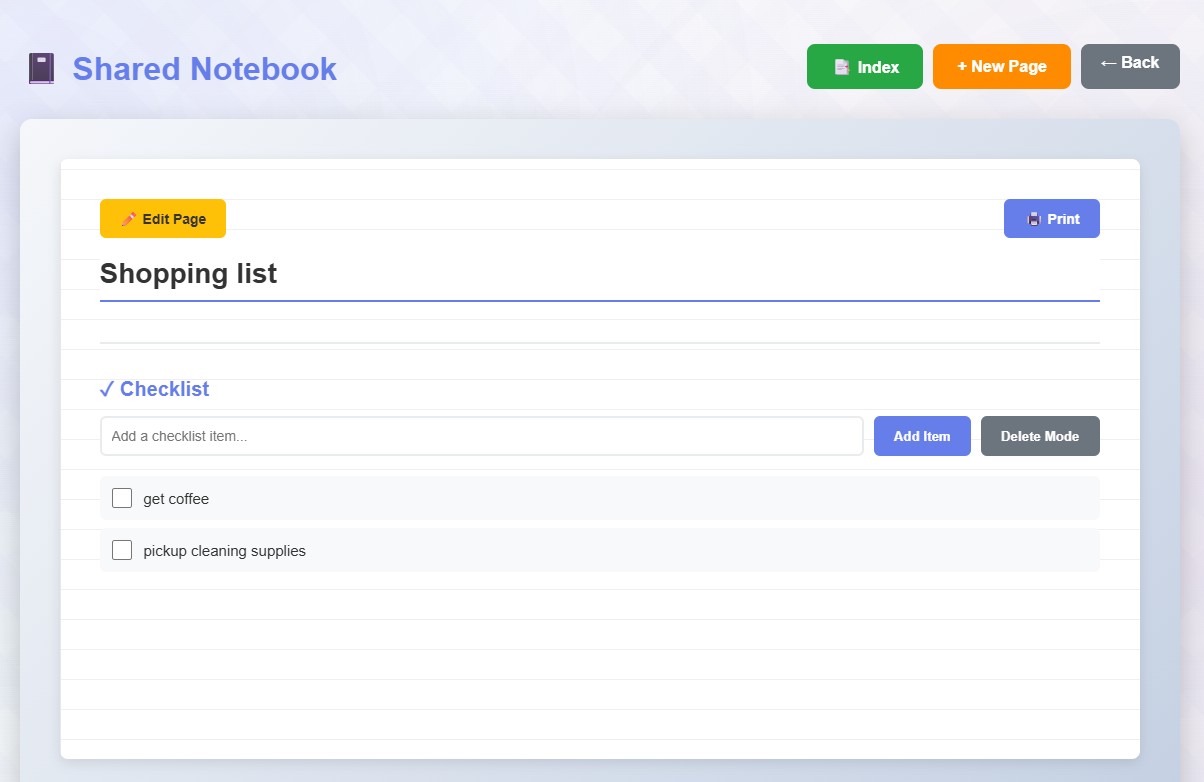

Digital Notebook

Keep financial notes, budget plans, and shopping lists. Interactive checklists help track tasks and monthly bills.

Quick Reminders

Sidebar reminders accessible from every page. Never forget important financial tasks or due dates.

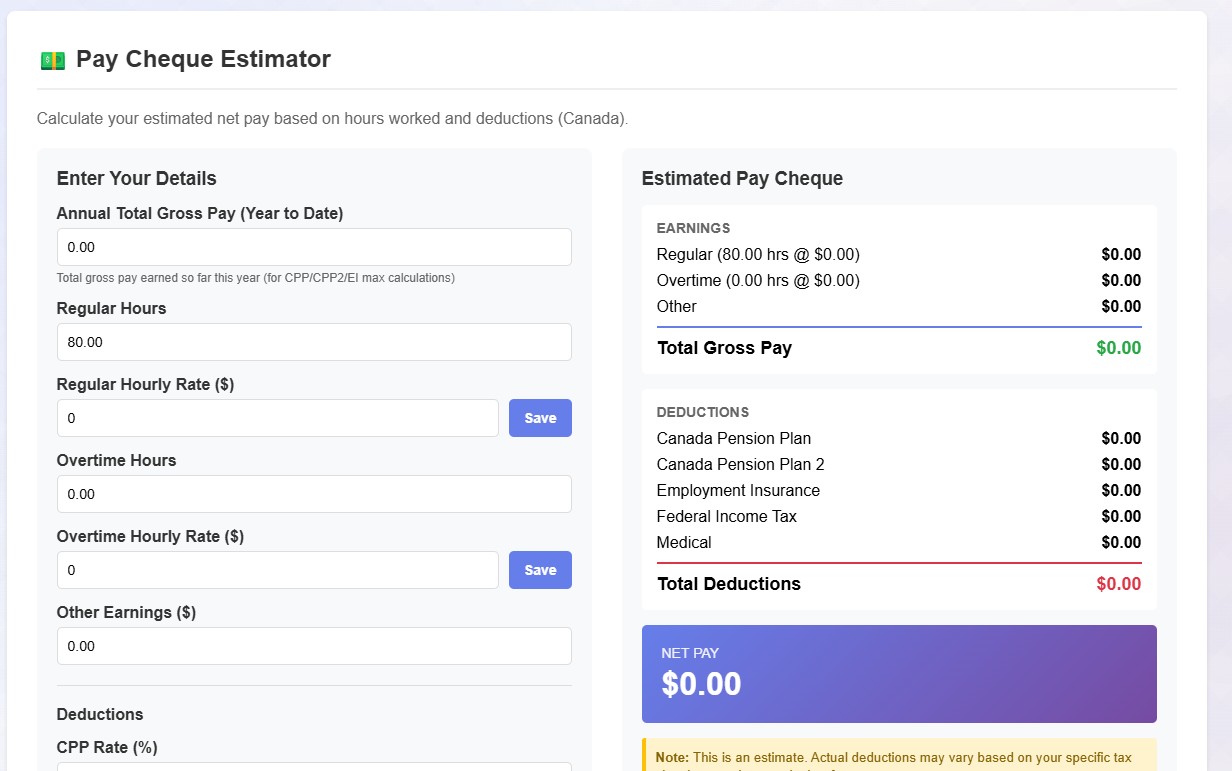

Canadian Paycheck Calculator

Calculate take-home pay after CPP, CPP2, EI, federal/provincial tax, and medical deductions. 2025 Canadian tax rates included.

USA Paycheck Calculator

Calculate net pay after Social Security, Medicare, federal/state tax, and medical deductions. 2025 USA tax rates with FICA wage base limits.

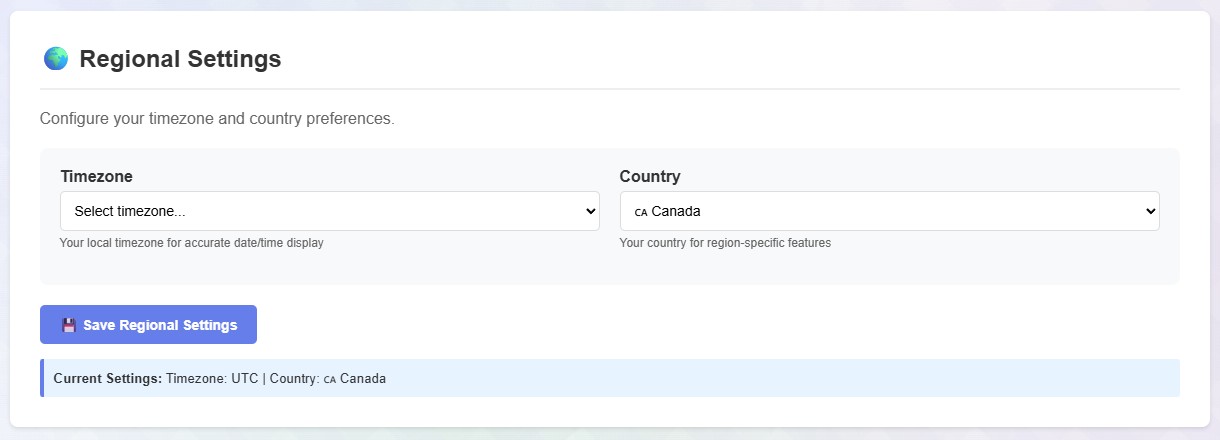

Marked Calendar Days

Mark important recurring dates on your account calendars with custom colored borders. Set specific days (1-31), last day of month, or weekday-only options. Perfect for tracking paydays, bill due dates, and financial milestones.

Complete Color-Coding System

Comprehensive visual indicators: green backgrounds for positive balances, red for negative, yellow for forecasts, blue for today. Thick colored borders highlight monthly high/low balance days. Custom colored borders for your marked important dates.

Visual Calendar Breakdown

See your entire month at a glance with the calendar forecast view. Each day shows the ending balance with color-coded status. Hover over any day to see transaction details and running balance throughout the day.

Category Deep Dive

Create unlimited subcategories under main categories for granular expense tracking. Analyze spending patterns by category and subcategory with detailed reports and visual breakdowns.

Smart Budget Management

Set monthly budgets for each expense category and track your spending in real-time. Visual progress bars show how much you've spent vs. budgeted, with color-coded warnings when approaching limits.

Budget vs Actual Charts

Interactive pie charts and line graphs visualize your budget distribution and spending patterns. Compare budgeted amounts to actual spending across multiple months to identify trends.

Budget Quick Actions

Copy last month's budget with one click, clear all budgets instantly, or hide zero-budget categories for a cleaner view. Streamline your monthly budget planning workflow.

Built-in Help Desk

Submit support tickets directly from the app. Track your requests and get personalized assistance when needed.

Account Balance Sync

Automatic balance syncing tools ensure accuracy. Fix discrepancies with one-click balance recalculation.

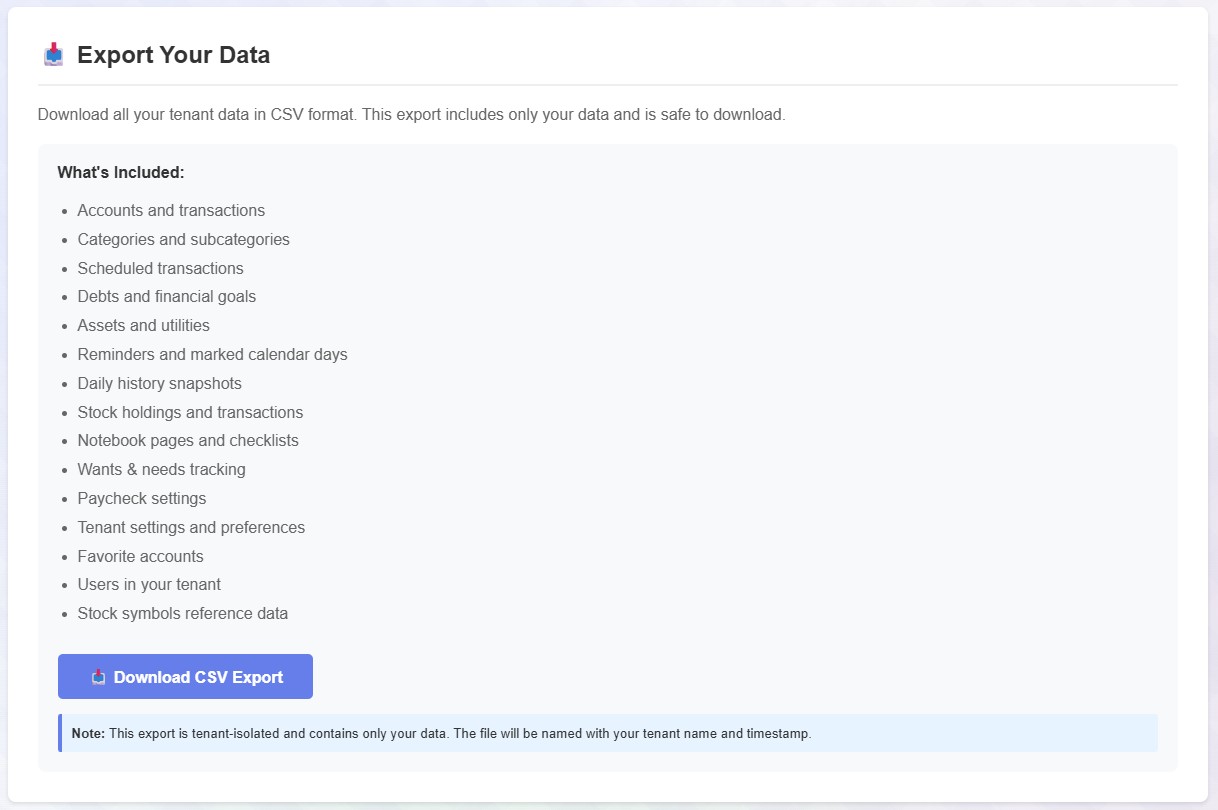

Data Export

Export all your financial data to CSV for external analysis or backup. Full data portability guaranteed.

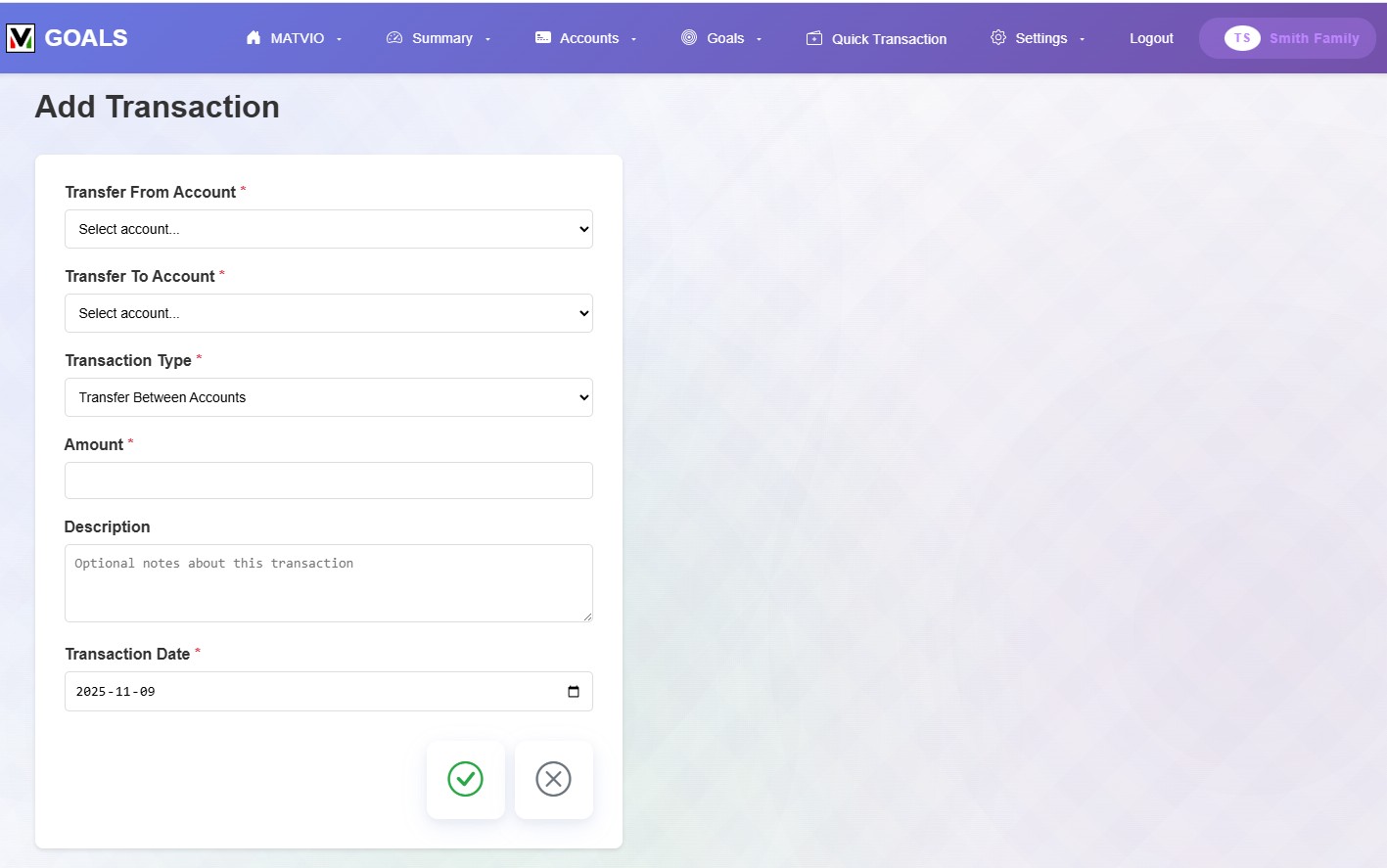

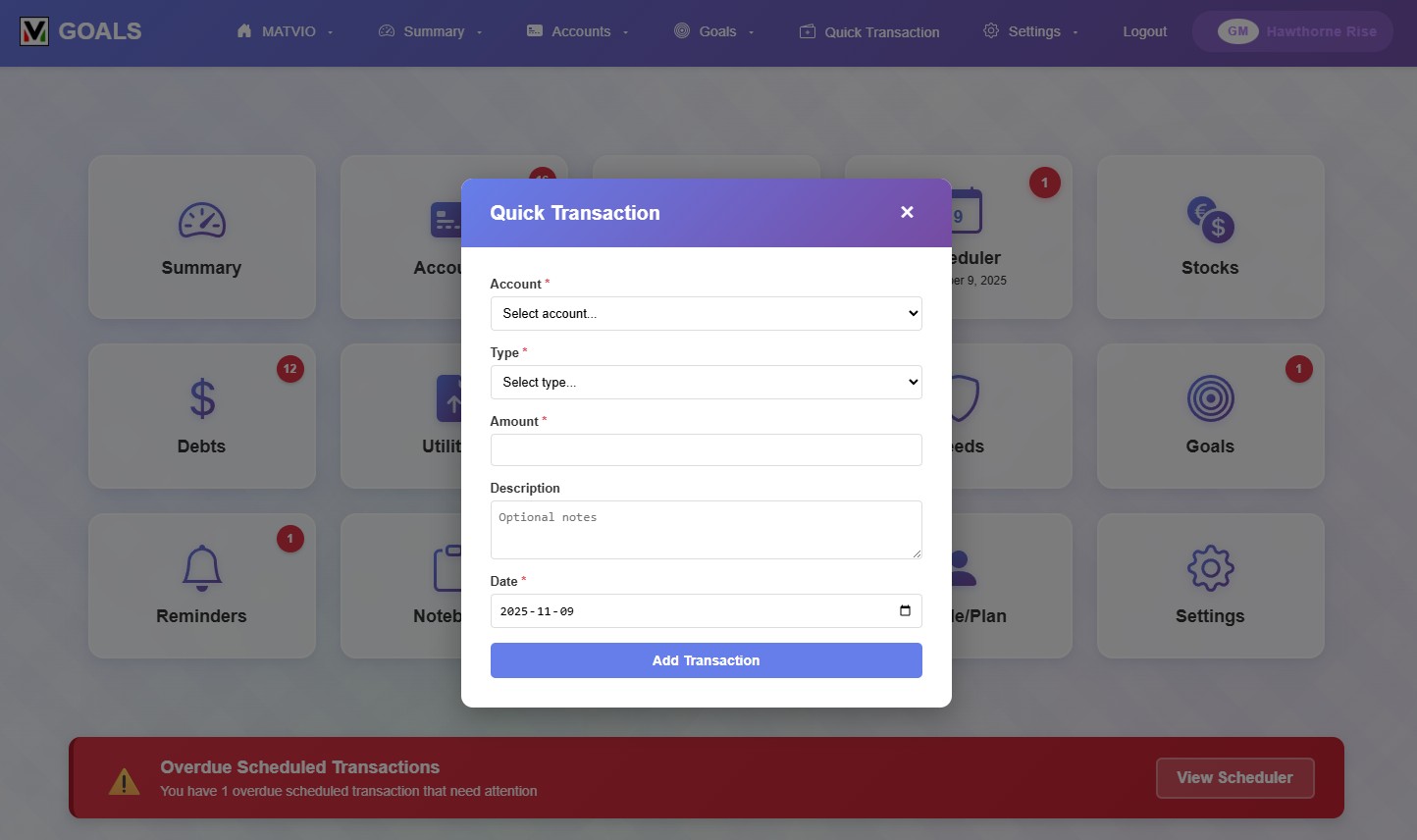

Quick Transaction Mode

Add expenses in seconds from anywhere in the app. Fast entry modal keeps you productive.

Custom Date Ranges

View transactions and forecasts for any date range. Analyze historical data or plan years ahead.

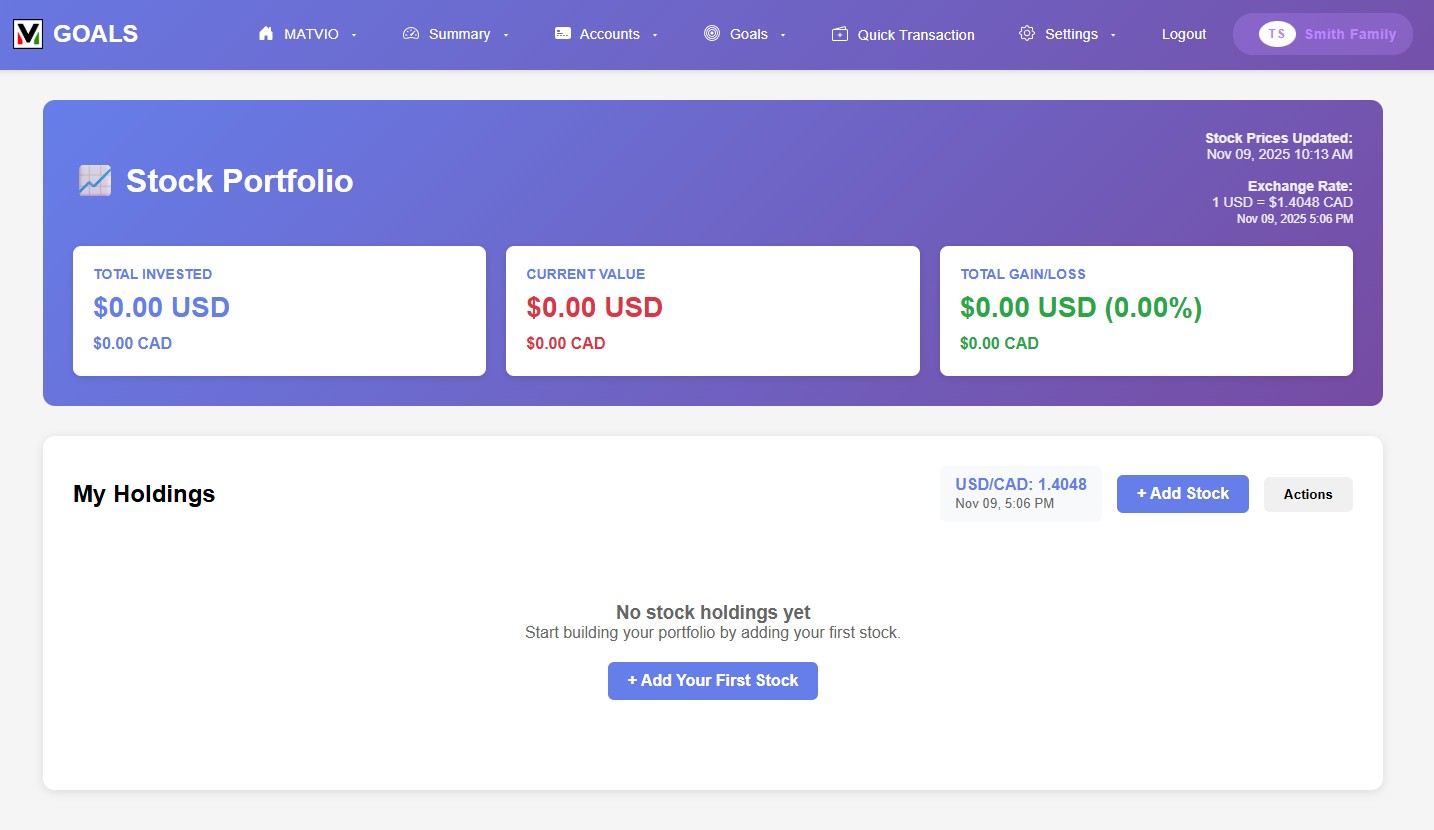

Stock Portfolio Tracking

Track stocks, ETFs, and mutual funds with real-time pricing. Monitor gains/losses, dividends, and portfolio performance with multi-currency support.

AI-Powered Financial Insights

Groq AI integration analyzes your financial data and provides intelligent summaries, personalized recommendations, and actionable insights. Get instant answers about your spending patterns, cash flow, and financial health.

Wants & Needs Analysis

Categorize spending as wants or needs. Visual breakdown helps you understand spending habits and make smarter financial decisions.

Marked Calendar Days

Mark important financial dates with custom colors and notes. Track bill due dates, payday, tax deadlines, and financial milestones.

Interactive Checklists

Create checklists in your notebook for monthly bills, tax preparation, financial reviews, and task tracking. Check items off as you complete them.

Daily History Snapshots

Automatic daily snapshots of all account balances and net worth. Track your financial progress over time with historical data.

Multi-Currency Support

Track investments in CAD, USD, and other currencies. Automatic exchange rate updates for accurate portfolio valuation.

Favorite Accounts

Mark your most-used accounts as favorites for quick access. Streamlined workflow for daily financial management.

Advanced Filtering

Filter transactions by date range, category, account, or amount. Powerful search tools help you find exactly what you need.

Debt Amortization

Complete payment schedules for mortgages and loans. See principal vs. interest breakdown. Canadian or USA-style mortgage calculations included.

📱 Take MATVIO GOALS Anywhere

Meet the MATVIO GOALS Companion App—your complete financial system optimized for mobile devices. Manage your money on the go to keep your powerful features you love on the desktop always in sync!

Install the PWA on your phone and access MATVIO GOALS like a native app—no app store required! simply go to https://goals.matvio.com/pwa/ from your browser on your mobile device!

Get Started in Minutes

MATVIO GOALS is designed to be powerful yet easy to use. Here's how to go from signup to full control in 4 simple steps.

Set Up Categories

Create income and expense categories that match your life. We provide common examples to get you started quickly.

Add Your Accounts

Enter your bank accounts, credit cards, and loans. Set opening and current balances to start tracking.

Schedule Recurring Items

Set up paychecks, bills, and regular expenses. MATVIO automatically forecasts them into the future.

Track & Forecast

Add daily transactions as they happen. View powerful forecasts to see your financial future and make confident decisions.

Advanced Charting & Forecasting Tools

See your financial future with crystal clarity through powerful visualization tools.

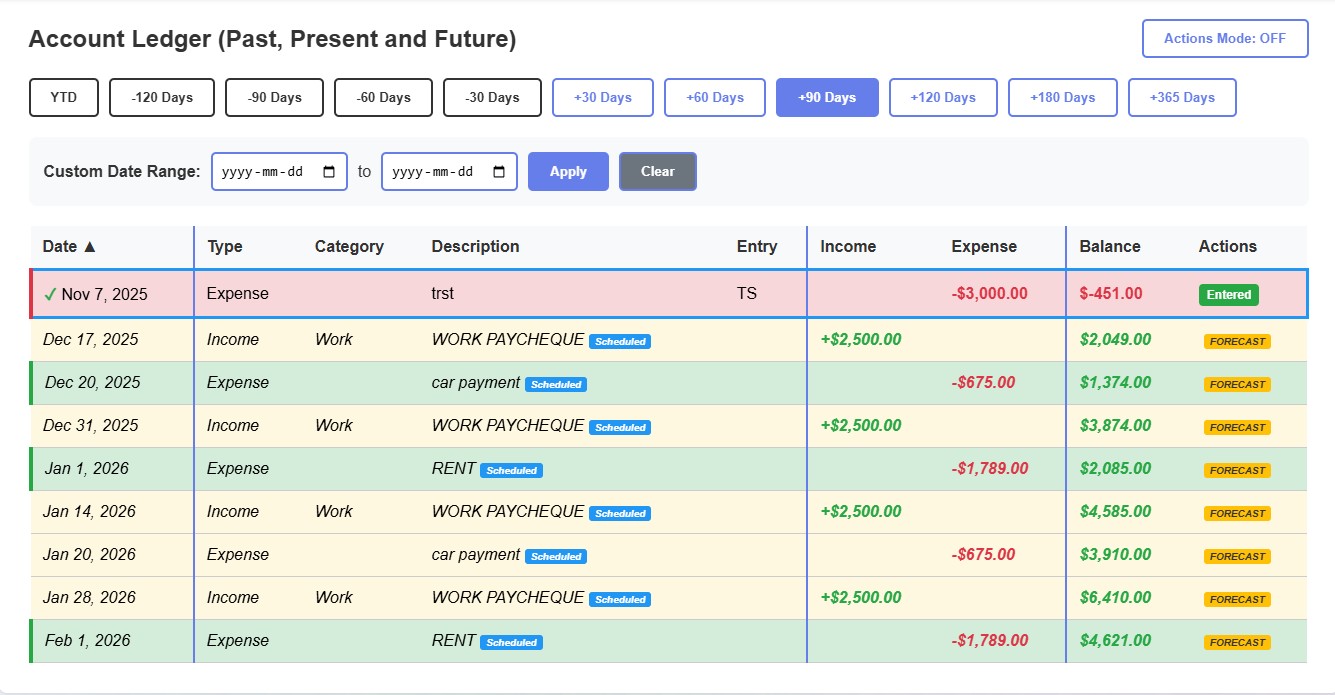

Account Ledger Forecasting

View any account's balance up to 730 days into the future with custom date ranges. Yellow highlighted rows show forecasted transactions from your scheduler. Blue borders mark today's date. Green/red thick borders show monthly low points—spot overdrafts before they happen.

Calendar Forecast View

Visual calendar displays daily balances with color-coded backgrounds: green for positive days, red for potential overdrafts, yellow for forecasted periods. Mark important dates with custom colored borders. Click any day to see all transactions and balance details.

Monthly High/Low Indicators

Automatic triangular markers show the highest and lowest balance days each month. Green triangles highlight your peak balance days, red triangles warn of critical low points. Never miss a potential overdraft again.

Balance Trend Charts & Analytics

Interactive line graphs show how your account balances change over time. Select different time ranges (30, 60, 90, 120, 180, 365+ days). Hover to see exact amounts on any date. Automatic transaction breakdown charts show income vs. expenses for any period.

Color-Coded Clarity System

Everything is color-coded for instant understanding: green for income/positive, red for expenses/negative, yellow for forecasts, blue for today. Monthly low balances are highlighted with thick borders so you never miss a critical cash flow point. Status badges on scheduler show due dates at a glance.

Smart Forecasting Engine

Scheduler automatically generates future transactions based on frequency (weekly, bi-weekly, monthly, yearly). Apply forecasts with one click when due. See exactly how your balance will look months ahead.

Debt Amortization Schedules

View complete payment schedules for mortgages and loans. See principal vs. interest breakdown for each payment. Canadian or USA-style mortgage calculations included.

Net Worth Tracking

Combine account balances, assets, and debts to calculate true net worth. Track wealth growth over time with historical snapshots.

Stock Portfolio Management

Track your investments with real-time stock prices. Monitor gains, losses, and dividends. Support for multiple currencies and exchanges.

Wants vs Needs Analysis

Understand your spending psychology. Categorize every purchase as a want or need, then see visual breakdowns to identify where you can save.

Monthly Budget Tracking

Set spending limits for each category and monitor your progress throughout the month. Real-time calculations show remaining budget, percentage used, and visual alerts when approaching limits. Compare budgeted vs. actual spending with interactive charts.

Multi-Month Budget Analysis

Track budget performance across multiple months with trend analysis. See which categories consistently go over or under budget. Visual line graphs compare your spending patterns month-over-month to help refine future budgets.

See MATVIO GOALS in Action

Explore our comprehensive financial management system through these screenshots

Simple, Transparent Pricing

Choose the perfect plan for your household. All plans include a 7-day free trial!

Special Limited-Time Pricing Available!

Plans marked as "Limited Time Special" are exclusive promotional offers available for a short period only. Once you subscribe to a special plan, you'll retain that pricing for as long as you maintain your subscription—even after the promotional period ends. Lock in these savings today!

GOALS 5

- 1 User Account

- 5 Financial Accounts

- 5 Debts

- 25 Goals

- 10 Utilities

GOALS 10

- 2 User Accounts

- 10 Financial Accounts

- 10 Debts

- 35 Goals

- 30 Utilities

GOALS 15

- 3 User Accounts

- 25 Financial Accounts

- 25 Debts

- 45 Goals

- 40 Utilities

GOALS 20

- 4 User Accounts

- 35 Financial Accounts

- 35 Debts

- 55 Goals

- 50 Utilities

GOALS 25

- 5 User Accounts

- 45 Financial Accounts

- 45 Debts

- 65 Goals

- 60 Utilities

GOALS 30

- 6 User Accounts

- 100 Financial Accounts

- 100 Debts

- 100 Goals

- 100 Utilities

Ready to Take Control?

Join families who've eliminated financial stress and achieved their goals with MATVIO GOALS

Get StartedEverything You Need to Succeed

Complete User Guide

Comprehensive documentation covers every feature with step-by-step instructions, examples, tips, and best practices. Never feel lost.

Quick Transaction Mode

Add expenses in seconds from any page. Fast modal entry keeps you productive.

Sidebar Access Tabs

Instant access to reminders and daily accounts from every page. Left and right sidebar tabs for maximum convenience.

Canadian Paycheck Calculator

Calculate take-home pay after CPP, CPP2, EI, federal/provincial tax, and medical deductions. 2025 Canadian tax rates for accurate income forecasting.

USA Paycheck Calculator

Calculate net pay with Social Security, Medicare, federal/state taxes, and deductions. Includes 2025 FICA limits and wage base calculations.

Notebook with Checklists

Multiple pages for notes and plans. Interactive checklists for tracking monthly bills, tax preparation, shopping, and more.

Balance Sync Tools

Recalculate all account balances from scratch. Repair tools ensure accuracy if discrepancies appear.

Account Analytics

Automatic transaction breakdowns with pie charts. See income vs. expenses for any time period at a glance.

Monthly Low Indicators

Thick colored borders highlight the lowest balance point each month. Avoid overdrafts before they happen.

Flexible Scheduling

Weekly, bi-weekly, semi-monthly, monthly, yearly, and one-time frequencies. Set max occurrences for time-limited items.

Login History Tracking

Monitor your last 20 logins with IP addresses and device info. Enhanced security and peace of mind.

Forecasted Entries

Yellow-highlighted future transactions from scheduler. See exactly when bills and income will hit your accounts.

Direct Bank Import

Download OFX/QFX files from your bank (Microsoft Money format) and import hundreds of transactions in seconds. Smart duplicate detection prevents duplicates automatically.

Multi-Tenant Architecture

Each family gets their own isolated database. Complete data privacy and security for every household.

Stock Transaction History

Complete record of all buy and sell transactions. Track cost basis, realized gains, and investment performance over time.

Custom Color Coding

Mark important calendar days with custom colors. Visual organization makes it easy to spot critical dates at a glance.

Notebook Organization

Multiple notebook pages for different topics. Keep financial notes, plans, and checklists all in one organized place.

Dividend Tracking

Record dividend payments from your investments. Track passive income and reinvestment opportunities.

Groq AI Integration

Connect your own Groq API key to unlock AI-powered financial analysis. Get comprehensive summaries of your reports, spending patterns, and account ledgers with intelligent insights powered by state-of-the-art language models like Llama 3.3 70B.

Personalized AI Recommendations

AI analyzes your income, expenses, and financial trends to provide personalized suggestions for improving cash flow, reducing expenses, and reaching your goals faster. Get actionable advice tailored to your unique financial situation.